Small Business - Automobile Taxable Benefits - Operating Cost Benefit

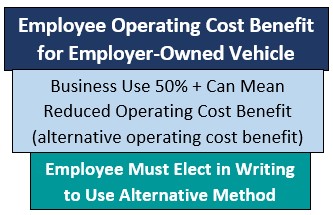

Automobile Taxable Benefits - Operating Cost Benefit, Reduction if Business Use 50% +

Buying a car for your business: 11 tips for a good small business investment

Small Business Employee Benefits (2024 Guide) – Forbes Advisor

:max_bytes(150000):strip_icc()/totalcostofownership.asp-final-c09b08a2bcfd495aa00e4dc73cae5871.png)

Total Cost of Ownership: How It's Calculated With Example

21 Tax Write-Offs for Small Businesses Tax Deductions - Guide

Small Business Expenses & Tax Deductions (2023)

Company cars: AIA and Company Cars: Tax Advantages Explained - FasterCapital

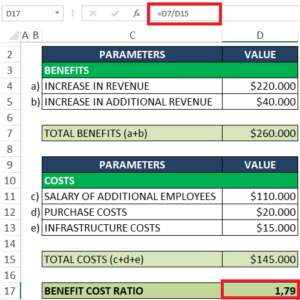

Cost Benefit Analysis Example and Steps (CBA Example) - projectcubicle

:max_bytes(150000):strip_icc()/Per-diem-payments_final-172c9facc092494e905cf2881907902f.png)

/thmb/iNm-VQwQvyphMv2vaOcTqnwL

CRA Gift Tax Rules for Employers - SRJ Chartered Accountants Professional Corporation

Court sides with CRA on travel allowance case

IRS Business Expense Categories List [+Free Worksheet]

Helping small businesses get loans

17 Big Tax Deductions (Write Offs) for Businesses