What Is Reasonable Proof Under The Michigan No-Fault Act?

Since being enacted more than 40 years ago, the Michigan No-Fault Act has been rather difficult to understand and apply. But despite the Act’s overall complexities, there are some no-fault concepts that have retained their elegant simplicity — and one of these is “reasonable proof.” Under the Michigan No-Fault Act, an insurance company is required to pay personal protection insurance (PIP) claims within 30 days of receiving “reasonable proof of the fact and of the amount of loss sustained.” If an insurer fails to do this, it is liable for 12% annual penalty interest. Liability for penalty interest is strict

Do Insurance Rates Go Up After a No-Fault Accident?

)/images/innerdome.jpg)

Michigan Legislature - Section 500.3142

Explanation of Michigan No-Fault Law

Michigan No-Fault Insurance Explained, Lipton Law

Buying, selling, or leasing

ACT/SAT for all: A cheap, effective way to narrow income gaps in

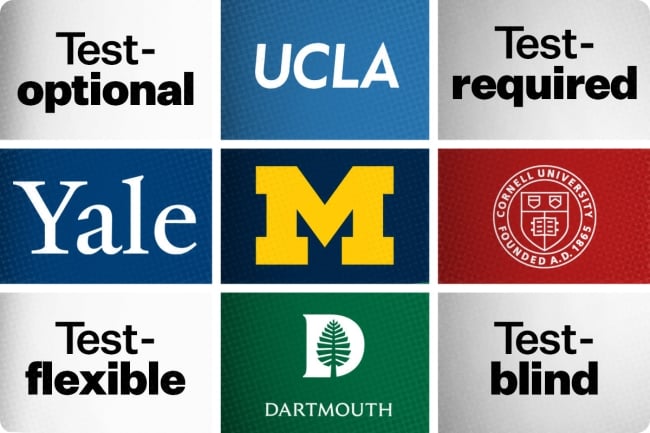

No emerging consensus on standardized test policies

Essential Actions for Academic Writing

Breaking a Lease in Michigan - A Comprehensive Guide

Michigan No-Fault Insurance Law Overview

Michigan No-Fault Act Broken Down - Michigan Auto Law

Blood Alcohol Level Chart (2024 Guide) – Forbes Advisor

Background on Michigan's No-Fault System

We've all heard the phrase “beyond a - Mike Morse Law Firm

How the New No-Fault Law Affects The Michigan Catastrophic