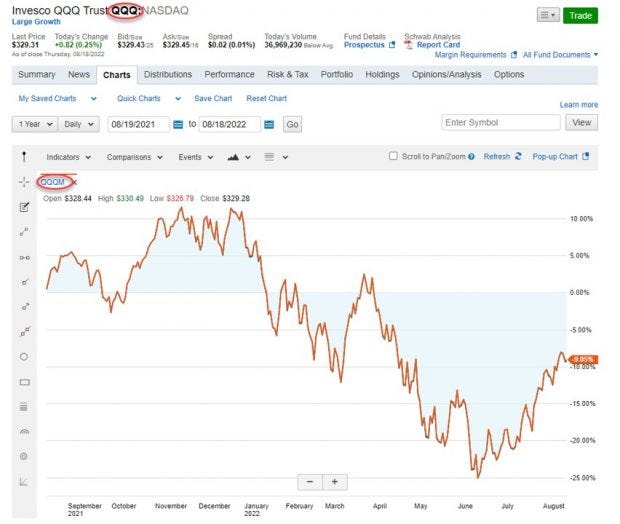

Comparing Nasdaq 100 ETFs: Real-Life Examples with QQQ & QQQM, by Dr. Alan Ellman, President of BCI

Over the years, the most frequently used ETF in my portfolios has been Invesco QQQ Trust (Nasdaq: QQQ). Premium members have noticed that, lately, a relatively new eligible security in our Premium…

Setting Our 20%/10% Guidelines After Rolling an Option Out or Out

Rolling-Up Our Cash-Secured Put Trades: A Real-Life Example with

Exit Strategy Choices After Exercise of a Cash-Secured Put: A Real

Covered Call Writing & Selling Cash-Secured Puts: Strategies or

How to Select the Best Covered Call Writing Strikes in Bear

The Blue Collar Investor on LinkedIn: Comparing Nasdaq 100 ETFs

The Poor Man's Covered Call LEAPS Selection: A Real-Life Example

The Blue Collar Investor on LinkedIn: Comparing Nasdaq 100 ETFs

Barron 39 S - Jan 10 2022, PDF, Inflation

Rolling-In Covered Call Trades. Exit strategy implementation is a

Calculating Realized Option & Unrealized Stock Covered Call

Calculating Mid-Contract Put-Selling Trade Status

How to Enter & Calculate Closing a Weekly Put Trade After Rolling